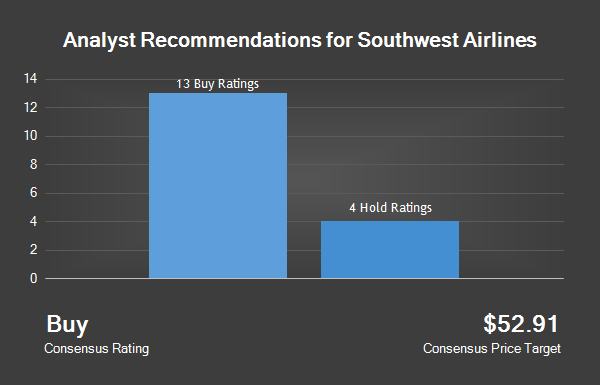

Southwest Airlines Co (NYSE:LUV) was upgraded by equities researchers at Vetr from a "hold" rating to a "buy" rating in a research note issued on Monday, MarketBeat.com reports. The firm presently has a $52.66 price objective on the airline's stock. Vetr's price objective indicates a potential upside of 4.38% from the stock's current price.

A number of other analysts have also weighed in on LUV. Imperial Capital initiated coverage on shares of Southwest Airlines in a research note on Friday, September 9th. They issued an "outperform" rating and a $46.00 price objective for the company. Credit Suisse Group AG set a $48.00 target price on shares of Southwest Airlines and gave the stock a "buy" rating in a report on Monday, September 12th. Bank of America Corp. set a $50.00 target price on shares of Southwest Airlines and gave the stock a "buy" rating in a report on Saturday, October 1st.

Sanford C. Bernstein initiated coverage on shares of Southwest Airlines in a report on Monday, October 10th. They issued an "outperform" rating and a $51.00 target price for the company. They noted that the move was a valuation call. Finally, JPMorgan Chase & Co. upgraded shares of Southwest Airlines from a "neutral" rating to an "overweight" rating and set a $51.50 target price for the company in a report on Thursday, October 27th.

Five investment analysts have rated the stock with a hold rating and fourteen have assigned a buy rating to the stock. The company has an average rating of "Buy" and an average price target of $52.52.

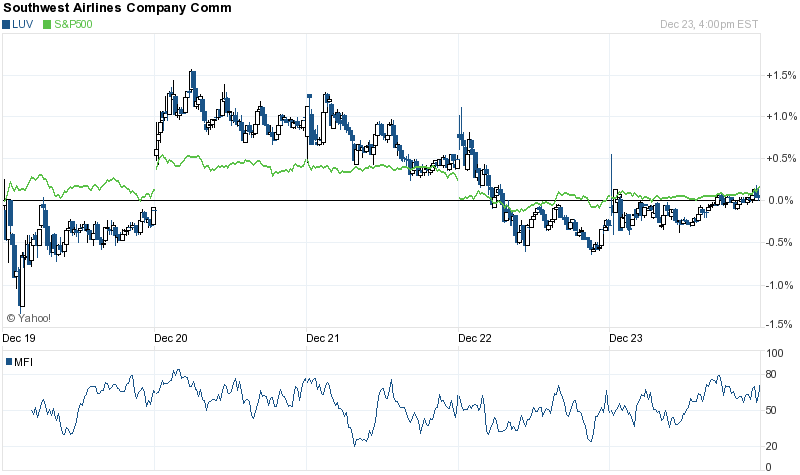

Southwest Airlines opened at 50.45 on Monday, MarketBeat.com reports. Southwest Airlines has a 12-month low of $33.96 and a 12-month high of $51.31. The company has a 50 day moving average of $47.31 and a 200-day moving average of $41.02. The stock has a market cap of $31.06 billion, a P/E ratio of 14.34 and a beta of 0.91.

Southwest Airlines last released its quarterly earnings data on Wednesday, October 26th. The airline reported $0.93 earnings per share for the quarter, topping the Zacks' consensus estimate of $0.88 by $0.05. Southwest Airlines had a net margin of 11.09% and a return on equity of 32.51%. The company earned $5.10 billion during the quarter, compared to analyst estimates of $5.17 billion. During the same period in the prior year, the firm earned $0.94 earnings per share. The firm's revenue for the quarter was down 3.4% compared to the same quarter last year. Equities analysts forecast that Southwest Airlines will post $3.66 earnings per share for the current year.

The firm also recently declared a quarterly dividend, which will be paid on Thursday, January 5th. Investors of record on Thursday, December 8th will be issued a $0.10 dividend. The ex-dividend date of this dividend is Tuesday, December 6th. This represents a $0.40 annualized dividend and a yield of 0.79%. Southwest Airlines's dividend payout ratio (DPR) is presently 11.40%.

In related news, Director John T. Montford sold 510 shares of the stock in a transaction that occurred on Thursday, December 15th. The shares were sold at an average price of $50.93, for a total value of $25,974.30. Following the transaction, the director now owns 23,715 shares in the company, valued at approximately $1,207,804.95. The sale was disclosed in a filing with the SEC, which is available through this link.

Also, EVP Jeff Lamb sold 14,534 shares of the stock in a transaction that occurred on Friday, December 2nd. The stock was sold at an average price of $48.10, for a total transaction of $699,085.40. Following the completion of the transaction, the executive vice president now owns 117,188 shares in the company, valued at approximately $5,636,742.80. The disclosure for this sale can be found here. 0.18% of the stock is currently owned by corporate insiders.

A number of institutional investors have recently modified their holdings of the company. Hanson McClain Inc. increased its position in shares of Southwest Airlines by 2.9% in the second quarter. Hanson McClain Inc. now owns 2,653 shares of the airline's stock valued at $104,000 after buying an additional 75 shares during the period. Washington Trust Bank increased its position in shares of Southwest Airlines by 6.9% in the third quarter. Washington Trust Bank now owns 2,704 shares of the airline's stock valued at $105,000 after buying an additional 174 shares during the period. Invictus RG increased its position in shares of Southwest Airlines by 637.0% in the second quarter. Invictus RG now owns 2,771 shares of the airline's stock valued at $109,000 after buying an additional 2,395 shares during the period.

1832 Asset Management L.P. acquired a new position in shares of Southwest Airlines during the second quarter valued at $115,000. Finally, Krilogy Financial LLC increased its position in shares of Southwest Airlines by 45.2% in the second quarter. Krilogy Financial LLC now owns 3,284 shares of the airline's stock valued at $129,000 after buying an additional 1,023 shares during the period. Institutional investors own 75.57% of the company's stock.

About Southwest Airlines

Southwest Airlines Co (Southwest) operates Southwest Airlines. Southwest is a passenger airline that provides scheduled air transportation in the United States and near-international markets. The Company serves approximately 100 destinations in over 40 states, such as the District of Columbia, the Commonwealth of Puerto Rico, and approximately seven near-international countries, including Mexico, Jamaica, The Bahamas, Aruba, Dominican Republic, Costa Rica, and Belize.